Each of the nominees is currently a director of Amazon.com, Inc. and has been elected to hold office until the 20162019 Annual Meeting or until his or her successor has been elected and qualified. Mr. Weeks wasMs. Brewer and Ms. Nooyi were elected as a directordirectors by the Board of Directors on February 10, 20164, 2019 and February 25, 2019, respectively, and the other nominees were most recently elected at the 20152018 Annual Meeting. Biographical and related information on each nominee is set forth below. On March 30, 2016, Alain MoniéApril 5, 2019, Tom A. Alberg informed the Company that he would not stand for re-election at the Annual Meeting.

Although the Board expects that the ten nominees will be available to serve as directors, if any of them should be unwilling or unable to serve, the Board may decrease the size of the Board or may designate substitute nominees, and the proxies will be voted in favor of any such substitute nominees.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH NOMINEE.

Director Nominees’ Biographical and Related Information

In evaluating the nominees for the Board of Directors, the Board and the Nominating and Corporate Governance Committee took into account the qualities they seek for directors, as discussed below under “Corporate Governance” and “Board Meetings and Committees,” and the directors’ individual qualifications, skills, and background that enable the directors to effectively and productively contribute to the Board’s oversight of Amazon.com.Amazon. These individual qualifications and skills are included below in each nominee’s biography.

Biographical Information

Jeffrey P. Bezos, age 52,55, has been Chairman of the Board since founding the Company in 1994 and Chief Executive Officer since May 1996. Mr. Bezos served as President from founding until June 1999 and again from October 2000 to the present. Mr. Bezos’ individual qualifications and skills as a director include his customer-focused point of view, his willingness to encourage invention, his long-term perspective, and hison-going contributions as founder and CEO.

Tom A. AlbergRosalind G. Brewer, age 76,56, has been a director since June 1996. Mr. AlbergFebruary 2019. Ms. Brewer has been the Group President, Americas and Chief Operating Officer of Starbucks Corporation, a managingroaster, marketer, and retailer of specialty coffee, since October 2017, where she has also served as a director since March 2017. From February 2012 to February 2017, she was President and Chief Executive Officer of Sam’s Club, a membership-only retail warehouse club and a division of Walmart Inc., and from 2006 to January 2012, she served in numerous leadership positions at various regional business units for Walmart. She served as a director of Madrona Venture Group, LLC, a venture capital firm, since September 1999, and a principal in Madrona Investment Group, LLC, a private investment firm, since January 1996. PriorLockheed Martin Corporation from April 2011 to co-founding Madrona Investment Group, Mr. Alberg served as president of LIN Broadcasting Corporation, Executive Vice President of McCaw Cellular Communications, Inc., and Executive Vice President of AT&T Wireless Services. Previously, he was chair of the Executive Committee and Partner at Perkins Coie, the Northwest’s largest law firm. Mr. Alberg’sOctober 2017. Ms. Brewer’s individual qualifications and skills as a director include his experience as a venture capitalist investing in technology companies, through which he gained experience with emerging technologies, his experience as a lawyer, his knowledge of Amazon.com from having served as a director since 1996, as well as his customer experience skills and skills relating to financial statement and accounting matters.

John Seely Brown, age 75, has been a director since June 2004. Mr. Brown has served as a Visiting Scholar and Advisor to the Provost at the University of Southern California (USC) since 1996 and as IndependentCo-Chairman of the Deloitte Center for the Edge since 2006. He held various scientific research positions at Xerox Corporation from 1978 until 2002, including Chief Scientist until April 2002 and director of the Xerox Palo Alto Research Center (PARC) until June 2000. Mr. Brown served as a director of Corning Incorporated from February 1996 to April 2014, and served as a director of Varian Medical Systems, Inc. from February 1998 to February 2013. Mr. Brown’s individual qualifications and skills as a director include his experience in senior positions with USC, a leading university, and Xerox PARC, a technology research facility, his role as Chief Scientist at Xerox Corporation, a global technology company, through which he gained experience with emerging technologies, as well as his customer experience skills.

William B. Gordon, age 66, has been a director since April 2003. Mr. Gordon has been a partner of Kleiner Perkins Caufield & Byers, a venture capital firm, since June 2008. Mr. Gordon is a co-founder of Electronic Arts, Inc., a software and gaming company, where he served as Executive Vice President and Chief Creative Officer

4

from March 1998 to May 2008, including heading marketing and product development. Mr. Gordon has served as a director of Zynga Inc. since July 2008. Mr. Gordon’s individual qualifications and skills as a director include hisher leadership and entrepreneurialoperations experience as a senior executive and co-founder of Electronic Arts,at large, multinational corporations, through which heshe gained experience with emerging technologiesregulatory and consumer-focused product development and marketing issues, experience as a venture capitalist investing in technologycompliance requirements applicable to public companies, as well as hisher customer experience skills and skills relating to financial statement and accounting matters.skills.

Jamie S. Gorelick, age 65,68, has been a director since February 2012. Ms. Gorelick has been a partner with the law firm Wilmer Cutler Pickering Hale and Dorr LLP since July 2003. She has held numerous positions in the U.S. government, serving as Deputy Attorney General of the United States, General Counsel of the Department of Defense, Assistant to the Secretary of Energy, and a member of the bipartisan National Commission on Terrorist Threats Upon the United States. Ms. Gorelick has served as a director of VeriSign, Inc. since January 2015, a director of United Technologies Corporation from February 2000 to December 2014, and a director of Schlumberger Limited from April 2002 to June 2010. Ms. Gorelick’s individual qualifications and skills as a director include her experience as a lawyer, her leadership experience in senior governmental positions, including experience with regulatory and compliance matters, as well as her customer experience skills and skills relating to public policy and financial statement and accounting matters.

4

Nature and extent of consultation with relevant stakeholders in connection with the assessment; and

Actual and/or potential human rights risks identified in the course of the human rights risk assessment related to Amazon’s use of labor contractors/subcontractors, temporary staffing agencies or similar employment arrangements (or a statement that no such risks have been identified).

The report should be made available to shareholders on Amazon’s website no later than May 31, 2017.

SUPPORTING STATEMENT

As long-term stockholders, we favor policies and practices that protect and enhance the value of our investments. There is increasing recognition that company risks related to human rights violations, such as reputational damage, fulfillment delays and disruptions, and litigation, can adversely affect shareholder value.

To manage such risks effectively, we believe companies must assess the risks to shareholder value posed by human rights practices in their operations and supply chain, as well as by the use of their products. The importance of such assessment is reflected in the United Nations Guiding Principles on Business and Human Rights (the “Ruggie Principles”) approved by the UN Human Rights Council in 2011. The Ruggie Principles urge that “business enterprises should carry out human rights due diligence [including] assessing actual and potential human rights impacts, integrating and acting upon the findings, tracking responses, and communicating how impacts are addressed.” (http://www.business-humanrights.org/media/documents/ruggie/ruggie-guiding-principles-21-mar-2011.pdf)

Amazon’s business model exposes the company to significant human rights risks. The launch of Prime Now triggered a class-action lawsuit alleging compensation below minimum wage. (Seehttp://www.bizjournals.com/sanfrancisco/blog/techflash/2015/10/fresh-off-s-f-launch-amazon-hit-with-class-action.html)

In Germany, Amazon hired a contractor to manage temporary employment agency staff. The contractor allegedly reneged on promised wages, kept migrant employees under surveillance and in cramped and unsuitable accommodation and supervised employees using guards whose uniforms had neo-Nazi connotations. (See http://www.businessweek.com/articles/2013-02-19/amazon-under-fire-over-alleged-worker-abuse-in-germany)

Amazon received a rating of “inadequate” and was ranked 144th out of 155 companies in a 2015 analysis of corporate conflict minerals policies by the Responsible Sourcing Network. As the report states, “The systems stakeholders are putting into place now will help companies manage risk in other regions where human rights abuses are linked to mineral extraction. Due diligence prepares companies for a more transparent and accountable future while tightening the net on conflict-affected minerals. (See sourcingnetwork.org).

Human rights risk assessment and reporting would help Amazon to identify and mitigate human rights risks and would allow shareholders to understand their potential impact on shareholder value.

We urge shareholders to vote for this proposal.

End of Shareholder Proposal and Statement of Support by SumOfUs

Recommendation of the Board of Directors on Item 4

The Board of Directors recommends that you vote against this proposal.

We are strongly committed to protecting human rights in our operations and supply chain. We are also strongly committed to conducting our business in a lawful and ethical manner, both in our own operations and through engagement with suppliers that are committed to the same principles. For example, we require suppliers in our manufacturing supply chain to comply with our Supplier Code of Conduct, which is detailed on our website (see http://www.amazon.com/gp/help/customer/display.html?nodeId=200885140). We also partner

16

closely with our suppliers to drive continuous improvement in worker conditions. We train our suppliers, Amazon employees who manage our manufacturing supply chain, and operations leadership on the standards and conduct required by our Supplier Code of Conduct.

Here are some of the key areas we focus on:

Health and safety in production areas and any living quarters.

The right to legal wages and benefits.

Appropriate working hours and overtime pay.

Prevention of child labor or forced labor.

Fair and ethical treatment, including non-discrimination.

We have a risk analysis process and audit tools, including audit protocols, trainings, and scorecards to best manage what we believe to be key risks in our supply chain. Our most senior leadership team regularly reviews performance on social responsibility goals and metrics across all Amazon businesses globally. We have teams in the U.S. and China who have expertise in social responsibility and will continue to evolve the program and manage to continuous improvement and best practices. In addition, we joined the EICC, a nonprofit coalition of companies committed to supporting the rights and well-being of workers and communities worldwide affected by the global electronics supply chain, and benchmarked our Supplier Code of Conduct to the EICC Code as is required of all EICC members.

We engage with all of our suppliers at least once a year to ensure they uphold all of Amazon’s standards and expectations as detailed in our Supplier Code of Conduct, and we conduct formal benchmarking with industry experts to review Amazon’s criteria against globally-recognized international standards, including the Ruggie Principles, and other businesses in the retail and electronics industries. We engage with our senior leadership internally on our own operations and with factory owners and managers in our supply chains to ensure they have a full understanding of our intent and goals for social responsibility and are implementing corrective actions in a timely manner when we find issues not in alignment with our Supplier Code of Conduct expectations.

We are committed to providing a safe and fair working environment to all of our employees globally. Any complaints about the working conditions at Amazon or any alleged violation of law are thoroughly investigated by the Company.

In light of our engagement and commitment to actions on these issues, we believe that the report requested under the proposal is not necessary.

THE BOARD RECOMMENDS THAT YOU VOTE “AGAINST” THIS PROPOSAL REGARDING A REPORT CONCERNING HUMAN RIGHTS.

ITEM 5—SHAREHOLDER PROPOSAL REGARDING A REPORT

CONCERNING CORPORATE POLITICAL CONTRIBUTIONS

Newground Social Investment, 10033 12th Ave. NW, Seattle, Washington 98177, acting on behalf of Bryce Mathern, a beneficial owner of 10 shares of common stock of the Company, has notified us that it intends to present the following resolution at the Annual Meeting. THE BOARD RECOMMENDS A VOTE “AGAINST” THIS SHAREHOLDER PROPOSAL.

Beginning of Shareholder Proposal and Statement of Support by Newground Social Investment:

WHEREAS: A majority of S&P 500 companies have webpages dedicated to disclosure of political and trade association spending.

17

TheCouncil of Institutional Investors,The Voice of Corporate Governance, represents more than $3 trillion in combined assets. Its Policy 2.14 states: “The board should develop and disclose publicly its guidelines for approving ... political contributions [and] ... should disclose ... the amounts and recipients of all ... contributions made by the company ... [including] expenditures earmarked for political or charitable activities that were provided to or through a third party.”

TheUS Securities and Exchange Commission has under consideration a disclosure rulemaking, which has received more than1.2 million comments in support of a rulemaking—far more than ever submitted on any rulemaking petition in history.

Shareowners have a right to know whether and how their company uses resources for political purposes. Yet existing regulatory frameworks create barriers—because disclosure is either dispersed among regulatory authorities or entirely absent when spending is channeled through independent organizations exempt from naming donors.

Amazon has at times placed a brief political spending statement on its website; however, key elements are absent from the statement, such that Amazon ranks quite poorly in theCPA-Zicklin Index of Corporate Accountability and Disclosure, which ranks companies according to the quality of their reporting.

At 35.7,Amazon treads water in the 4th tier and scores well behindeBay at 85.7, Intel at 94.3, and Northwest peersMicrosoft at 95.7 (#5 in the 2015 ranking),Boeing at 84.3, andStarbucks at 77.1.

Amazon could significantly elevate its rank by putting into place a handful of essential, but missing, elements. We view these steps as constituting ‘low-hanging fruit’—straightforward measures for Amazon to take, but important for our Company’s reputation and beneficial to shareholder value.

The Board and shareholders need comprehensive disclosure to be able to fully evaluate the risks associated with Amazon’s political use of corporate assets.

THEREFORE, BE IT RESOLVED: Shareholders request a report, updated semiannually, that discloses Amazon’s:

| (a) | Policies and procedures for making political contributions and expenditures with corporate funds (both direct and indirect), including the Board’s role (if any) in that process, and |

| (b) | Monetary and non-monetary political contributions or expenditures that cannot be deducted as an “ordinary and necessary” business expense under section 162(e) of the Internal Revenue Code (“IRC”). |

This would include (but not be limited to) contributions to or expenditures on behalf of political candidates, parties, or committees, and other entities organized and operating under IRC section 501(c)(4); as well as the portion of any dues or payments that are made to any tax-exempt organization (such as a trade association) that are used in a way that, if made directly by the Company, would not be deductible under IRC section 162(e).

The initial report shall be made available within 12 months of the annual meeting and should identify recipients, as well as the amount(s) paid to each recipient from Company funds.

End of Shareholder Proposal and Statement of Support by Newground Social Investment

Recommendation of the Board of Directors on Item 5

The Board of Directors recommends that you vote against this proposal.

We have posted on our website, at www.amazon.com/ir, a political expenditures statement, which is updated annually. As noted in our political expenditures statement, our political expenditures are approved by

18

our Vice President of Global Public Policy, reviewed by our Senior Vice President for Corporate Affairs and General Counsel, and reported on to our Audit Committee.

In January 2016 we made several enhancements to our annual political expenditures report to include disclosure of each U.S.-based trade association to which we contribute at least $10,000 through the Company’s Public Policy Office, and disclosure of each ballot initiative contribution (including the amount). We also added a requirement that the Company’s Senior Vice President for Corporate Affairs review all political expenditures.

We participate in the policymaking process by informing public officials about our positions on issues significant to our customers and our business. In 2015, we made contributions to state and local candidates in California, Washington State, and the city of Seattle, and to a political action committee in the city of Seattle, and we have disclosed those contributions (including the amounts) in our political expenditures statement. As disclosed on our website, in 2015 the Company made a contribution to a ballot initiative in Washington State. The political expenditures statement discloses our 2015 spending on federal government relations efforts, which are also required to be reported to the House and Senate and made publicly available at http://lobbyingdisclosure.house.gov/ and http://www.senate.gov/legislative/Public_Disclosure/LDA_reports.htm.

The political expenditures statement also discloses our 2015 spending on state government relations efforts, which are generally required to be reported and disclosed on applicable state websites such as those maintained by secretaries of state, state ethics and public disclosure commissions, state legislatures, and similar websites.

We also belong to certain trade associations, coalitions, and social welfare organizations, many of which engage in efforts to inform policymakers on issues important to their members. The political expenditures statement discloses the U.S.-based trade associations, coalitions, and social welfare organizations to which we contributed at least $10,000 in 2015 through the Company’s Public Policy Office.

Finally, as noted in the political expenditures statement, we have formed, and cover the administrative expenses of, a political action committee (“PAC”), but the PAC is funded by voluntary contributions from some of our employees and shareholders, and their spouses—not corporate funds. The PAC’s activities are subject to federal regulation, including detailed public disclosure requirements. The PAC files regular public reports with the Federal Election Commission (“FEC”), and political contributions to and by the PAC are required to be disclosed. These reports are publicly available on the FEC website at http://www.fec.gov/disclosure.shtml.

In 2010, 2012, 2013, 2014, and 2015 this political contributions proposal failed with approximately 79%, 78%, 76%, 79%, and 81% respectively, of the shares present at the meeting declining to vote for such proposal. We do not believe that preparing an additional ad hoc report as requested in the proposal would be an effective and prudent use of the Company’s time and resources.

THE BOARD RECOMMENDS THAT YOU VOTE “AGAINST” THIS PROPOSAL REGARDING A

REPORT CONCERNING CORPORATE POLITICAL CONTRIBUTIONS.

19

BENEFICIAL OWNERSHIP OF SHARES

The following table sets forth certain information regarding the beneficial ownership of our common stock as of February 17, 201625, 2019 (except as otherwise indicated) by (i) each person or entity known by us to beneficially own more than 5% of our common stock, (ii) each director, (iii) each executive officer for whom compensation information is given in the Summary Compensation Table in this Proxy Statement, and (iv) all directors and executive officers as a group. Except as otherwise indicated, and subject to any interests of the reporting person’s spouse, we believe that the beneficial owners of common stock listed below, based on information furnished by such owners, have sole voting and investment power with respect to such shares. As of February 17, 201625, 2019 we had 470,899,185491,759,743 shares of common stock outstanding.

| Name and Address of Beneficial Owner | | Amount and

Nature of

Beneficial

Ownership | | Percent of

Class | | | Amount and

Nature of

Beneficial

Ownership | | Percent of

Class | |

Jeffrey P. Bezos 410 Terry Avenue North, Seattle, WA 98109 | | | 82,914,385 | | | | 17.6 | % | |

Jeffrey P. Bezos | | | | 78,814,170 | | | 16.0 | % |

410 Terry Avenue North, Seattle, WA 98109 | | | | | |

The Vanguard Group, Inc. | | | | 30,528,310 | (1) | | 6.2 | % |

100 Vanguard Blvd, Malvern, PA 19355 | | | | | |

BlackRock, Inc. | | | | 25,807,758 | (2) | | 5.2 | % |

55 East 52nd Street, New York, NY 10055 | | | | | |

Tom A. Alberg | | | 29,245 | (1) | | | * | | | | 15,648 | (3) | | * | |

John Seely Brown | | | 12,686 | | | | * | | |

William B. Gordon | | | 3,573 | | | | * | | |

Rosalind G. Brewer | | | | — | | | * | |

Jamie S. Gorelick | | | 4,483 | | | | * | | | | 6,448 | | | * | |

Daniel P. Huttenlocher | | | | 573 | | | * | |

Judith A. McGrath | | | 840 | | | | * | | | | 2,324 | | | * | |

Alain Monié | | | 7,150 | | | | * | | |

Brian T. Olsavsky | | | 59 | | | | * | | |

Indra K. Nooyi | | | | — | | | * | |

Jonathan J. Rubinstein | | | 6,905 | | | | * | | | | 7,893 | | | * | |

Thomas O. Ryder | | | 20,653 | | | | * | | | | 9,241 | | | * | |

Patricia Q. Stonesifer | | | 25,423 | | | | * | | | | 6,486 | | | * | |

Thomas J. Szkutak | | | 37,233 | | | | * | | |

Wendell P. Weeks | | | | 1,365 | | | * | |

Brian T. Olsavsky | | | | 1,068 | | | * | |

Jeffrey M. Blackburn | | | | 67,459 | (4) | | * | |

Andrew R. Jassy | | | 76,257 | | | | * | | | | 95,568 | | | * | |

Diego Piacentini | | | 84,146 | | | | * | | |

Wendell P. Weeks | | | — | | | | * | | |

Jeffrey A. Wilke | | | 78,127 | (2) | | | * | | | | 71,515 | (5) | | * | |

All directors and executive officers as a group (18 persons) | | | 83,351,097 | (3) | | | 17.7 | % | |

All directors and executive officers as a group (17 persons) | | | | 79,108,731 | (6) | | 16.1 | % |

| (1) | As of December 31, 2018, based on information provided in a Schedule 13G filed February 11, 2019. The Vanguard Group has sole voting power with respect to 506,109 of the reported shares, shared voting power with respect to 90,420 of the reported shares, sole investment power with respect to 29,941,568 of the reported shares, and shared investment power with respect to 586,742 of the reported shares. |

| (2) | As of December 31, 2018, based on information provided in a Schedule 13G filed February 4, 2019. BlackRock, Inc. has sole voting power with respect to 22,370,646 of the reported shares, shared voting power with respect to 0 of the reported shares, and sole investment power with respect to all of the reported shares. |

| (3) | Includes 7,0003,450 shares held by a charitable trust of which Mr. Alberg is a trustee and as to which he shares voting and investment power. Mr. Alberg disclaims beneficial ownership of such shares. |

(2)(4) | Includes 13,80320,000 shares as to which Mr. Blackburn shares or may be deemed to share voting and investment power. Mr. Blackburn disclaims beneficial ownership of such shares. |

| (5) | Includes 41,999 shares as to which Mr. Wilke shares or may be deemed to share voting and investment power. Mr. Wilke disclaims beneficial ownership of such shares. |

(3)(6) | Includes 87,1658,973 shares beneficially owned by other executive officers not individually listed in the table and 20,000 shares as to which one of the other executive officers may be deemed to share voting and investment power.table. |

2041

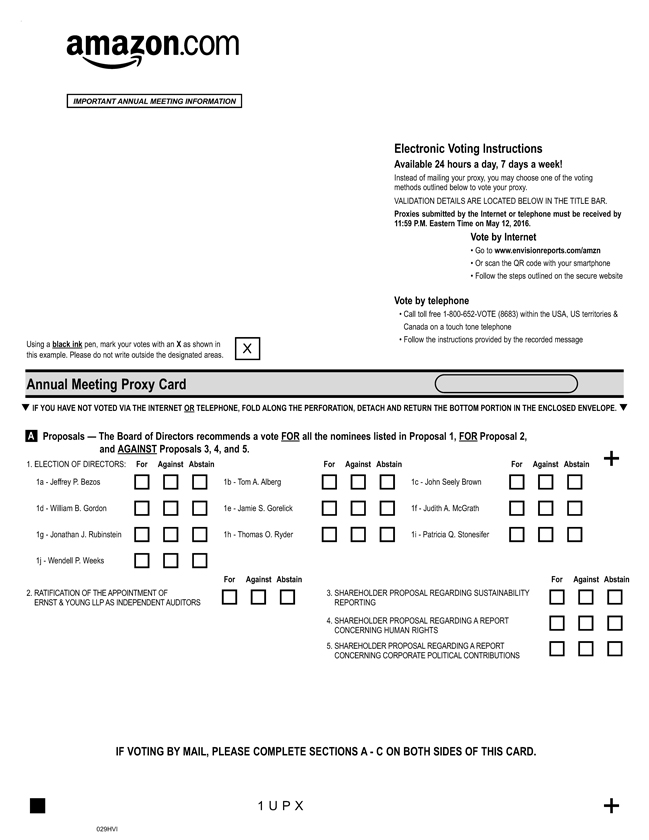

IMPORTANT ANNUAL MEETING INFORMATION

Electronic Voting Instructions

Available 24 hours a day, 7 days a week!

Instead of mailing your proxy, you may choose one of the voting methods outlined below to vote your proxy.

VALIDATION DETAILS ARE LOCATED BELOW IN THE TITLE BAR.

Proxies submitted by the Internet or telephone must be received by 11:59 P.M. Eastern Time on May 16, 2016.

Vote by Internet

Go to www.envisionreports.com/amzn

Or scan the QR code with your smartphone

Follow the steps outlined on the secure website

Vote by telephone

Call toll free 1-800-652-VOTE (8683) within the USA, US territories & Canada on a touch tone telephone

Follow the instructions provided by the recorded message

Amazon Using a black ink pen, mark your votes with an X as shown in this example. Please do not write outside the designated areas.

X 02ZEMR 1 P C F + Annual Meeting Proxy Card

IF YOU HAVE NOT VOTED VIA THE INTERNET OR TELEPHONE, FOLD ALONG THE PERFORATION, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE.

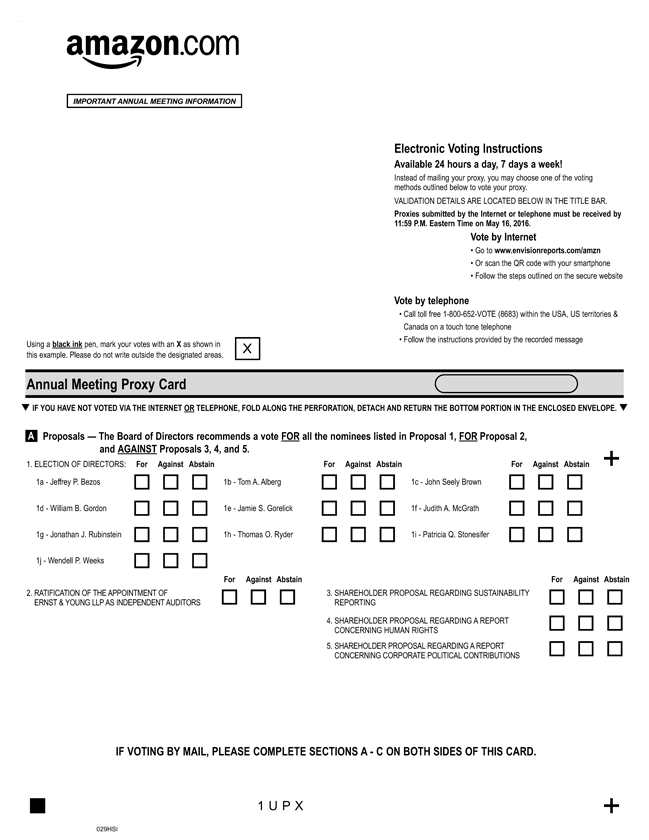

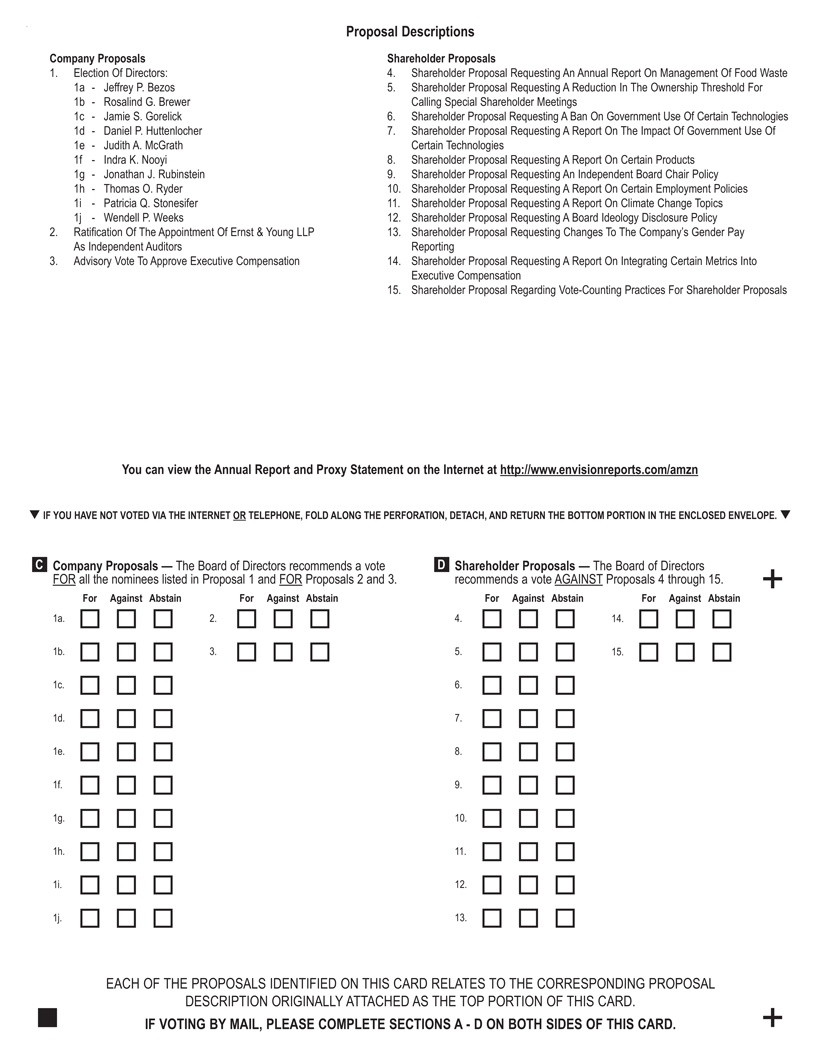

A Proposals . IMPORTANT ANNUAL MEETING INFORMATION Change of Address — The Board of Directors recommends a vote FOR allPlease print your new address below. Comments — Please print your comments below.Non-Voting Items Meeting Attendance Mark the nominees listed in Proposal 1, FOR Proposal 2, and AGAINST Proposals 3, 4, and 5.

1. ELECTION OF DIRECTORS: For Against Abstain For Against Abstain For Against Abstain

1a - Jeffrey P. Bezos 1b - Tom A. Alberg 1c - John Seely Brown

1d - William B. Gordon 1e - Jamie S. Gorelick 1f - Judith A. McGrath

1g - Jonathan J. Rubinstein 1h - Thomas O. Ryder 1i - Patricia Q. Stonesifer

1j - Wendell P. Weeks

For Against Abstain For Against Abstain

2. RATIFICATION OF THE APPOINTMENT OF 3. SHAREHOLDER PROPOSAL REGARDING SUSTAINABILITY

ERNST & YOUNG LLP AS INDEPENDENT AUDITORS REPORTING

4. SHAREHOLDER PROPOSAL REGARDING A REPORT

CONCERNING HUMAN RIGHTS

5. SHAREHOLDER PROPOSAL REGARDING A REPORT

CONCERNING CORPORATE POLITICAL CONTRIBUTIONS

IF VOTING BY MAIL, PLEASE COMPLETE SECTIONS A - C ON BOTH SIDES OF THIS CARD.

1UPX +

029HSI

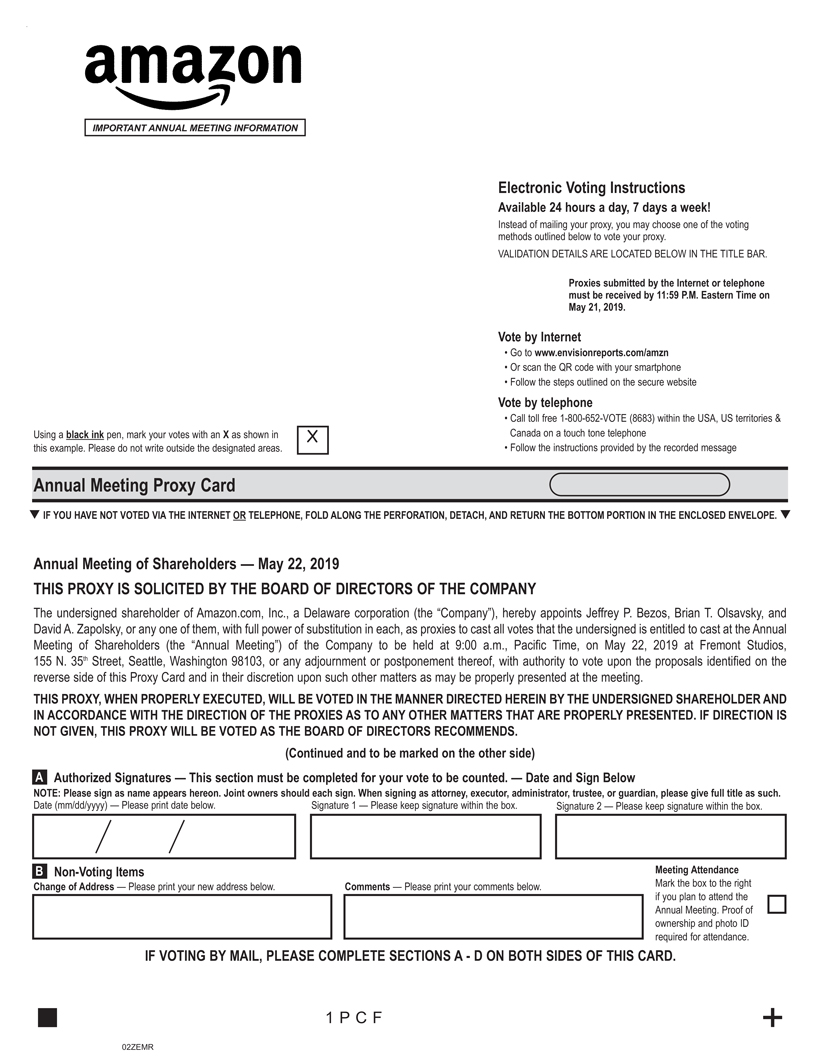

You can viewbox to the right if you plan to attend the Annual ReportMeeting. Proof of ownership and Proxy Statement onphoto ID required for attendance. Authorized Signatures — This section must be completed for your vote to be counted. — Date and Sign Below NOTE: Please sign as name appears hereon. Joint owners should each sign. When signing as attorney, executor, administrator, trustee, or guardian, please give full title as such. Date (mm/dd/yyyy) — Please print date below. Signature 1 — Please keep signature within the Internet at http://www.envisionreports.com/amzn

IF YOU HAVE NOT VOTED VIA THE INTERNET OR TELEPHONE, FOLD ALONG THE PERFORATION, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE.

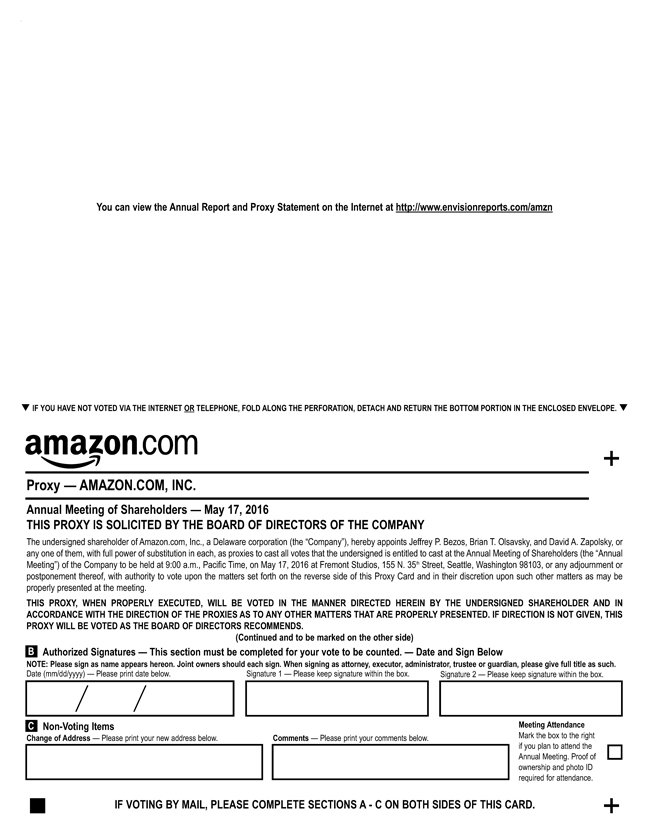

Proxybox. Signature 2 — AMAZON.COM, INC.

Please keep signature within the box. Annual Meeting of Shareholders — May 17, 2016

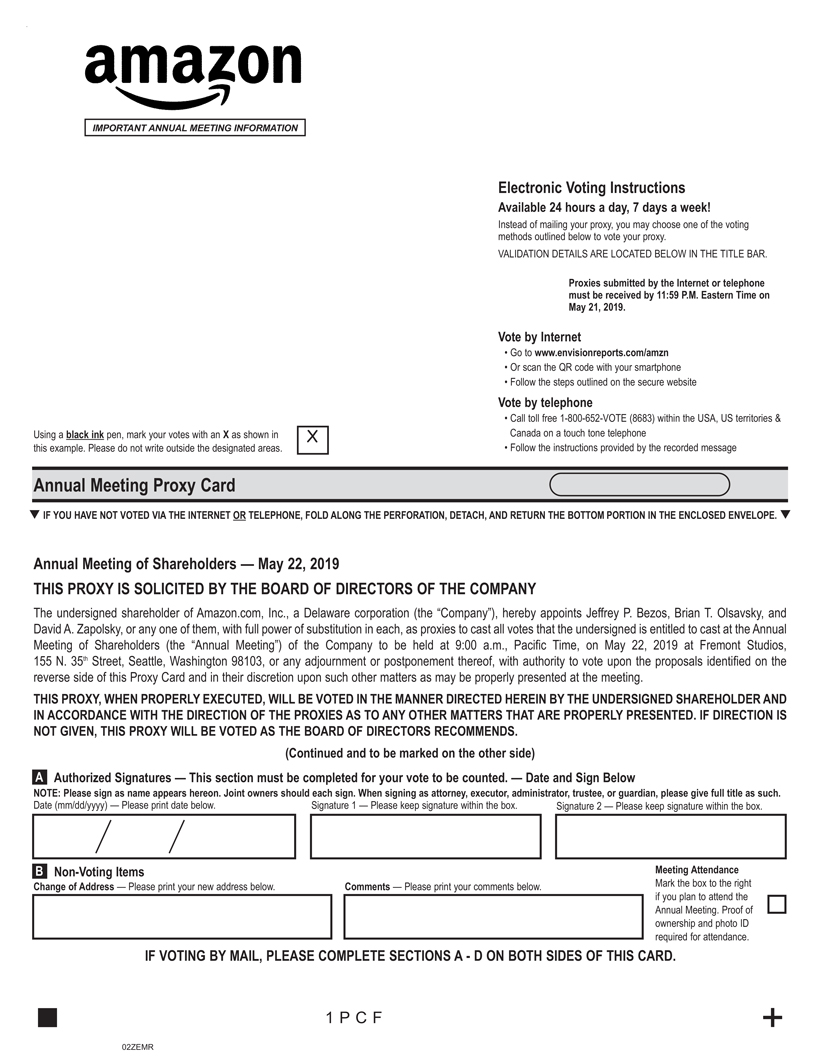

22, 2019 THIS PROXY IS SOLICITED BY THE BOARD OF DIRECTORS OF THE COMPANY

The undersigned shareholder of Amazon.com, Inc., a Delaware corporation (the “Company”), hereby appoints Jeffrey P. Bezos, Brian T. Olsavsky, and David A. Zapolsky, or

any one of them, with full power of substitution in each, as proxies to cast all votes that the undersigned is entitled to cast at the Annual Meeting of Shareholders (the “Annual

Meeting”) of the Company to be held at 9:00 a.m., Pacific Time, on May 17, 201622, 2019 at Fremont Studios, 155 N. 35th Street, Seattle, Washington 98103, or any adjournment or

postponement thereof, with authority to vote upon the matters set forthproposals identified on the reverse side of this Proxy Card and in their discretion upon such other matters as may be

properly presented at the meeting.

THIS PROXY, WHEN PROPERLY EXECUTED, WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED SHAREHOLDER AND IN

ACCORDANCE WITH THE DIRECTION OF THE PROXIES AS TO ANY OTHER MATTERS THAT ARE PROPERLY PRESENTED. IF DIRECTION IS NOT GIVEN, THIS

PROXY WILL BE VOTED AS THE BOARD OF DIRECTORS RECOMMENDS.

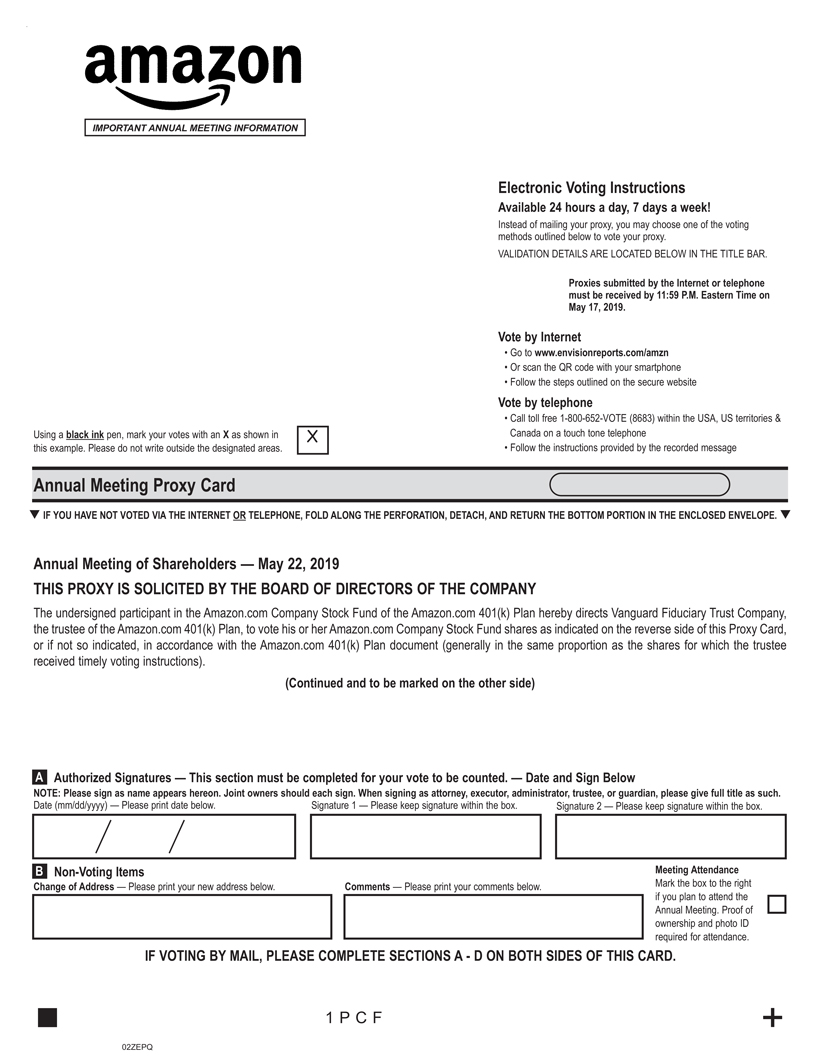

(Continued (Continued and to be marked on the other side) IF VOTING BY MAIL, PLEASE COMPLETE SECTIONS A—D ON BOTH SIDES OF THIS CARD. qIF YOU HAVE NOT VOTED VIA THE INTERNET OR TELEPHONE, FOLD ALONG THE PERFORATION, DETACH, AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE.q Electronic Voting Instructions Available 24 hours a day, 7 days a week! Instead of mailing your proxy, you may choose one of the voting methods outlined below to vote your proxy. VALIDATION DETAILS ARE LOCATED BELOW IN THE TITLE BAR. Vote by Internet • Go to www.envisionreports.com/amzn • Or scan the QR code with your smartphone • Follow the steps outlined on the secure website Vote by telephone • Call toll free1-800-652-VOTE (8683) within the USA, US territories & Canada on a touch tone telephone • Follow the instructions provided by the recorded message Proxies submitted by the Internet or telephone must be received by 11:59 P.M. Eastern Time on May 21, 2019.

Amazon Using a black ink pen, mark your votes with an X as shown in this example. Please do not write outside the designated areas. X 02ZEPQ 1 P C F + Annual Meeting Proxy Card . IMPORTANT ANNUAL MEETING INFORMATION Change of Address — Please print your new address below. Comments — Please print your comments below.Non-Voting Items Meeting Attendance Mark the box to the right if you plan to attend the Annual Meeting. Proof of ownership and photo ID required for attendance. Authorized Signatures — This section must be completed for your vote to be counted. — Date and Sign Below

NOTE: Please sign as name appears hereon. Joint owners should each sign. When signing as attorney, executor, administrator, trustee, or guardian, please give full title as such.

Date (mm/dd/yyyy) — Please print date below. Signature 1 — Please keep signature within the box. Signature 2 — Please keep signature within the box.

C Non-Voting Items Meeting Attendance

Change of Address — Please print your new address below. Comments — Please print your comments below. Mark the box to the right

if you plan to attend the

Annual Meeting. Proof of

ownership and photo ID

required for attendance.

IF VOTING BY MAIL, PLEASE COMPLETE SECTIONS A - C ON BOTH SIDES OF THIS CARD. +

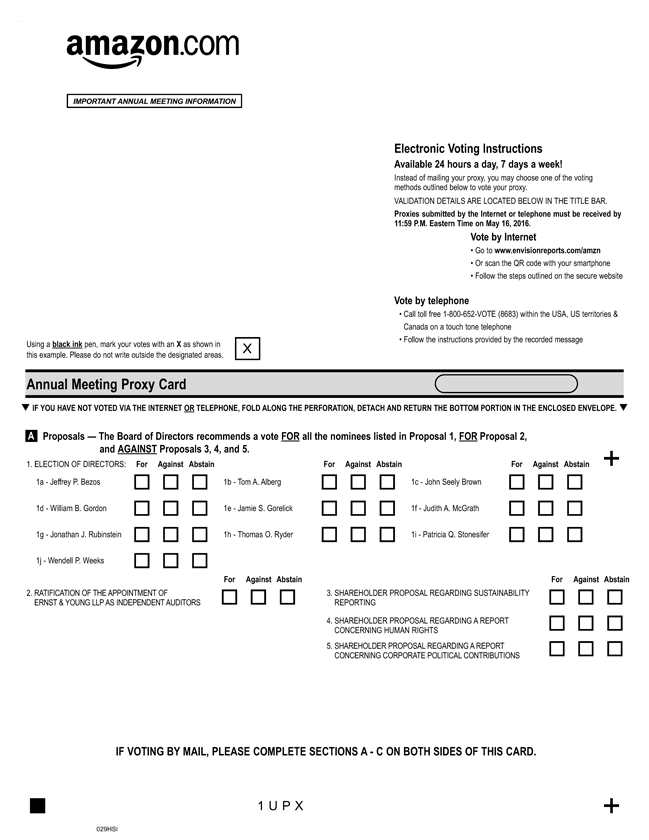

IMPORTANT ANNUAL MEETING INFORMATION

Electronic Voting Instructions

Available 24 hours a day, 7 days a week!

Instead of mailing your proxy, you may choose one of the voting

methods outlined below to vote your proxy.

VALIDATION DETAILS ARE LOCATED BELOW IN THE TITLE BAR.

Proxies submitted by the Internet or telephone must be received by

11:59 P.M. Eastern Time on May 12, 2016.

Vote by Internet

Go to www.envisionreports.com/amzn

Or scan the QR code with your smartphone

Follow the steps outlined on the secure website

Vote by telephone

Call toll free 1-800-652-VOTE (8683) within the USA, US territories &

Canada on a touch tone telephone

Follow the instructions provided by the recorded message

Using a black ink pen, mark your votes with an X as shown in this example. Please do not write outside the designated areas.

Annual Meeting Proxy Card

IF YOU HAVE NOT VOTED VIA THE INTERNET OR TELEPHONE, FOLD ALONG THE PERFORATION, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE.

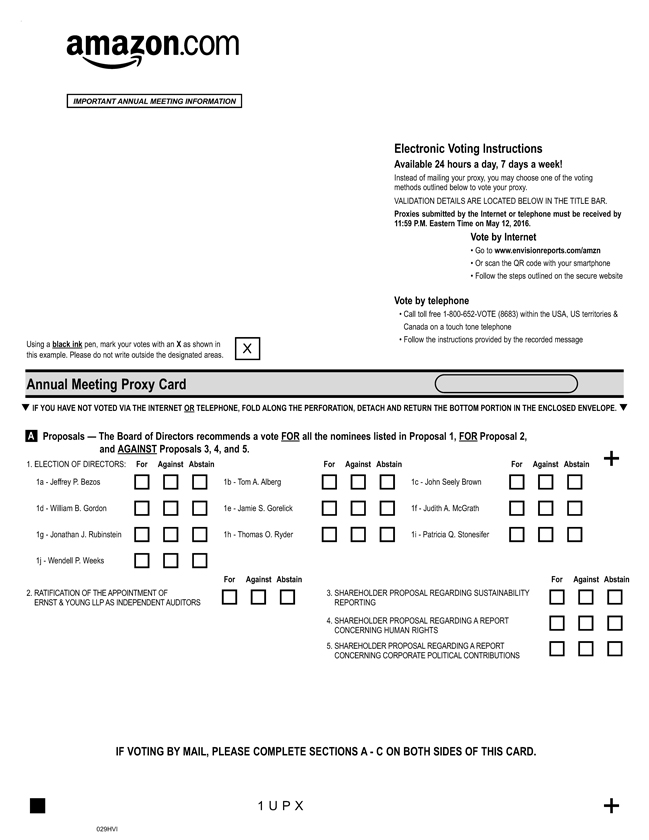

A Proposals — The Board of Directors recommends a vote FOR all the nominees listed in Proposal 1, FOR Proposal 2, and AGAINST Proposals 3, 4, and 5.

1. ELECTION OF DIRECTORS: For Against

Abstain

For Against Abstain

For Against

Abstain

1a - Jeffrey P. Bezos

1b - Tom A. Alberg

1c - John Seely Brown

1d - William B. Gordon

1e - Jamie S. Gorelick

1f - Judith A. McGrath

1g - Jonathan J. Rubinstein

1h - Thomas O. Ryder

1i - Patricia Q. Stonesifer

1j - Wendell P. Weeks

For Against Abstain

For

Against

Abstain

2. RATIFICATION OF THE APPOINTMENT OF

3. SHAREHOLDER PROPOSAL REGARDING SUSTAINABILITY

ERNST & YOUNG LLP AS INDEPENDENT AUDITORS

REPORTING

4. SHAREHOLDER PROPOSAL REGARDING A REPORT

CONCERNING HUMAN RIGHTS

5. SHAREHOLDER PROPOSAL REGARDING A REPORT

CONCERNING CORPORATE POLITICAL CONTRIBUTIONS

IF VOTING BY MAIL, PLEASE COMPLETE SECTIONS A - C ON BOTH SIDES OF THIS CARD.

1UPX

029HVI

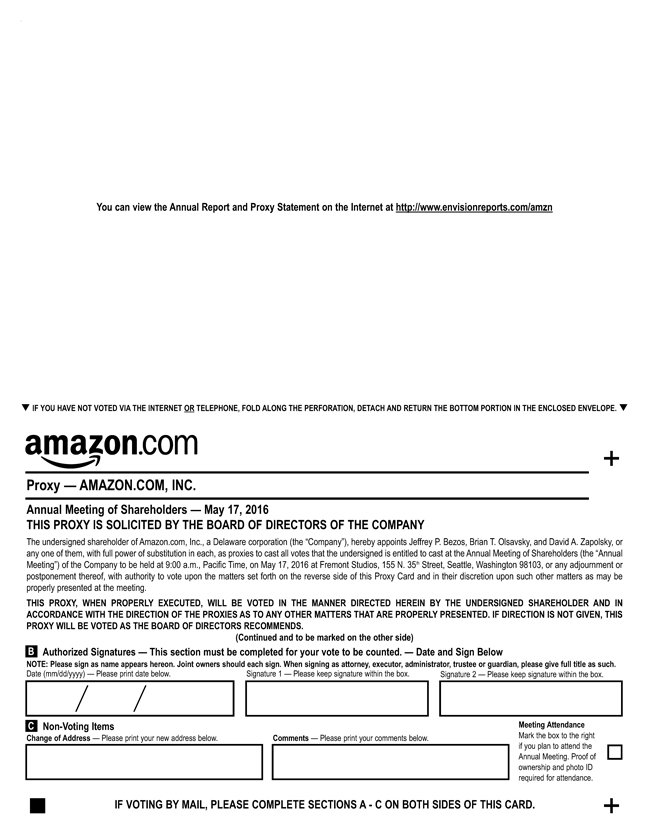

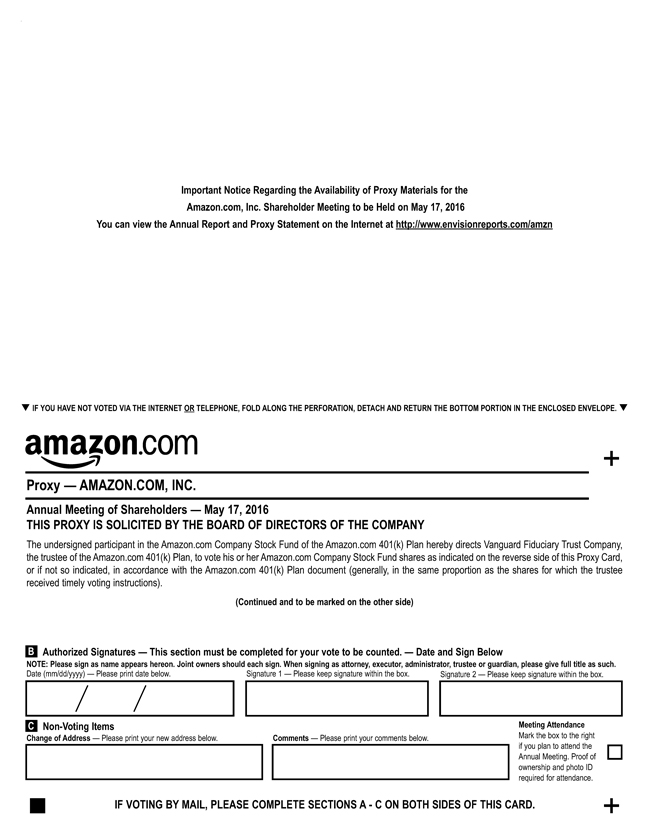

Important Notice Regarding the Availability of Proxy Materials for the Amazon.com, Inc. Shareholder Meeting to be Held on May 17, 2016

You can view the Annual Report and Proxy Statement on the Internet at http://www.envisionreports.com/amzn

IF YOU HAVE NOT VOTED VIA THE INTERNET OR TELEPHONE, FOLD ALONG THE PERFORATION, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE.

Proxy — AMAZON.COM, INC.

Annual Meeting of Shareholders — May 17, 2016

22, 2019 THIS PROXY IS SOLICITED BY THE BOARD OF DIRECTORS OF THE COMPANY

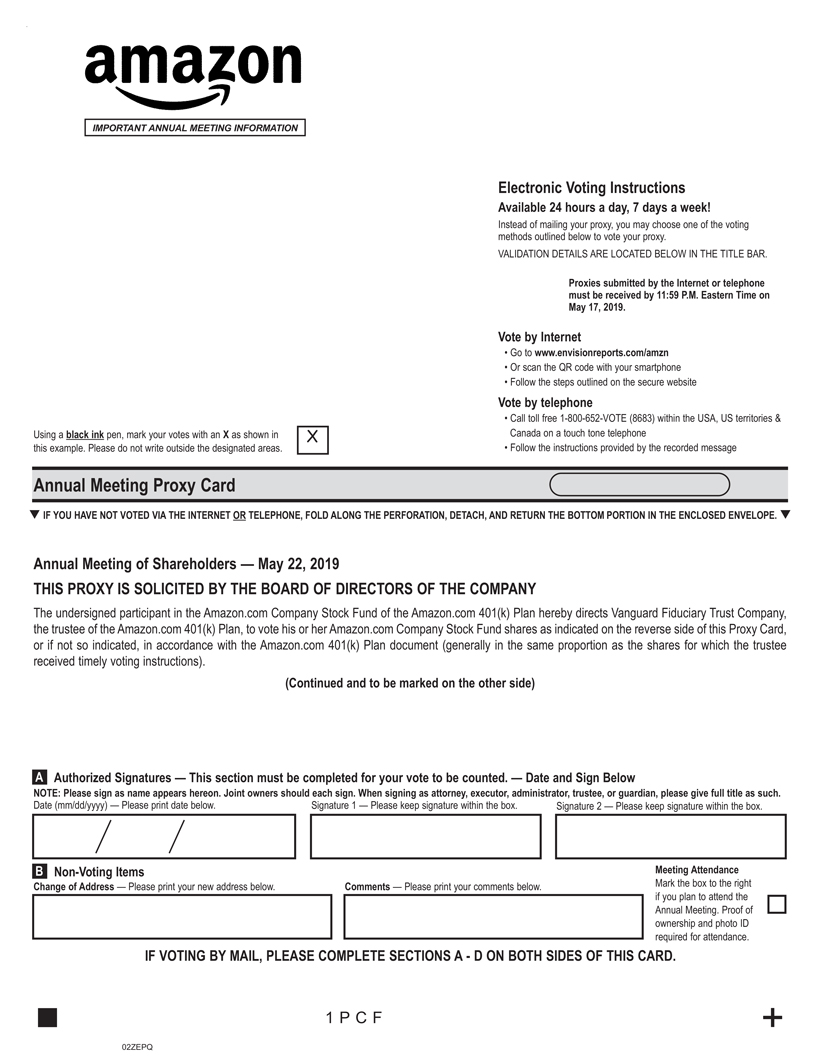

The undersigned participant in the Amazon.com Company Stock Fund of the Amazon.com 401(k) Plan hereby directs Vanguard Fiduciary Trust Company, the trustee of the Amazon.com 401(k) Plan, to vote his or her Amazon.com Company Stock Fund shares as indicated on the reverse side of this Proxy Card, or if not so indicated, in accordance with the Amazon.com 401(k) Plan document (generally in the same proportion as the shares for which the trustee received timely voting instructions).

(Continued (Continued and to be marked on the other side)

B Authorized Signatures — This section must be completed for your vote to be counted. — Date and Sign Below

NOTE: Please sign as name appears hereon. Joint owners should each sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such.

Date (mm/dd/yyyy) — Please print date below.

Signature 1 — Please keep signature within the box.

Signature 2 — Please keep signature within the box.

C Non-Voting Items

Meeting Attendance

Change of Address — Please print your new address below.

Comments — Please print your comments below.

Mark the box to the right

if you plan to attend the

Annual Meeting. Proof of

ownership and photo ID

required for attendance.

IF VOTING BY MAIL, PLEASE COMPLETE SECTIONS A - CA—D ON BOTH SIDES OF THIS CARD. qIF YOU HAVE NOT VOTED VIA THE INTERNET OR TELEPHONE, FOLD ALONG THE PERFORATION, DETACH, AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE.q Electronic Voting Instructions Available 24 hours a day, 7 days a week! Instead of mailing your proxy, you may choose one of the voting methods outlined below to vote your proxy. VALIDATION DETAILS ARE LOCATED BELOW IN THE TITLE BAR. Vote by Internet • Go to www.envisionreports.com/amzn • Or scan the QR code with your smartphone • Follow the steps outlined on the secure website Vote by telephone • Call toll free1-800-652-VOTE (8683) within the USA, US territories & Canada on a touch tone telephone • Follow the instructions provided by the recorded message Proxies submitted by the Internet or telephone must be received by 11:59 P.M. Eastern Time on May 17, 2019.

+

..

..